Licensing play an integral part of the business model of licensors (biotech) and licensees (pharma) in the drug development industry. The current deal trend of increasing complexity of licensee contracts, including sublicensing, co-development, call-back options, profit sharing, tiered royalties, or sales milestones make valuation a challenge. Traditional rules of thumb, such a the value share principle commonly employed by big pharma, are not sufficient anymore as guidelines in negotiations of deal terms. We ensure that you understand how even the most complicated license contracts translate into value in order not to leave value on the negotiation table.

We maintain a database of more than 10,000 deals, track milestones and royalties, review current deal trends and analyzing performance drivers. We ensure that you understand the value and risk of a term sheet that enable you to negotiate financial terms that are fair for both parties.

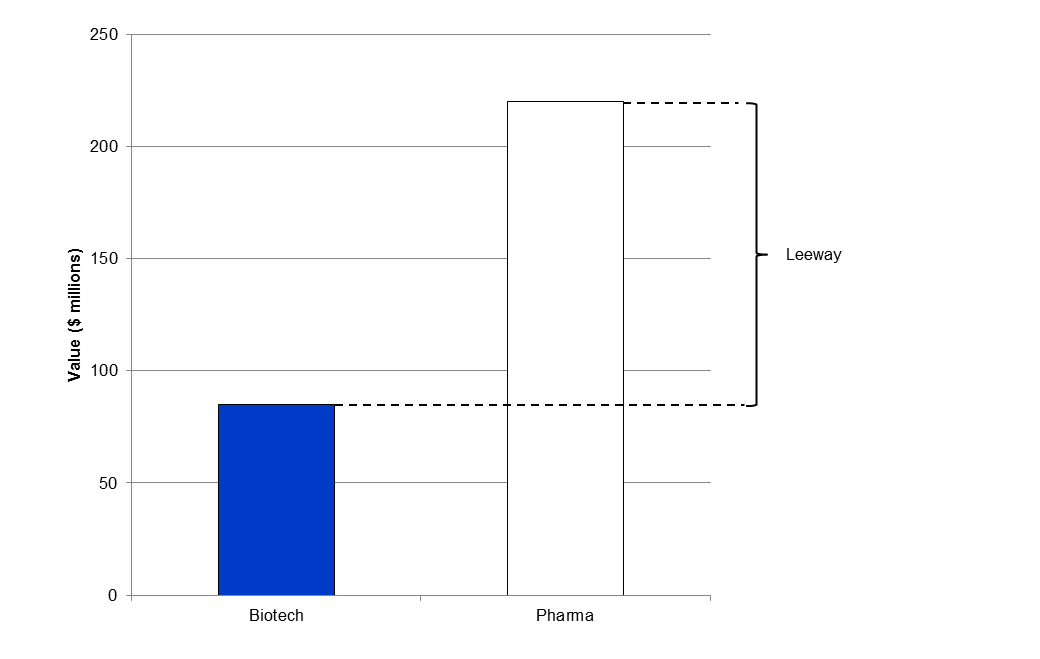

Depending on the stage of negotiations, we help you to either prepare an initial draft terms sheet or improve an existing one by reviewing current deal trends and analyzing performance drivers. You will know your leeway, thresholds for the licensee and the licensor, and have rational arguments to ask for better deal terms.

Once we have clarified with the client the preference for cash, risk, upside potential, allocation of cash flow rights, control and property rights, and expected total deal value, we come back with a range of possible license contracts including a low ball and high ball offer, a low and a high risk term sheet. The client can then decide with which term sheet to proceed.

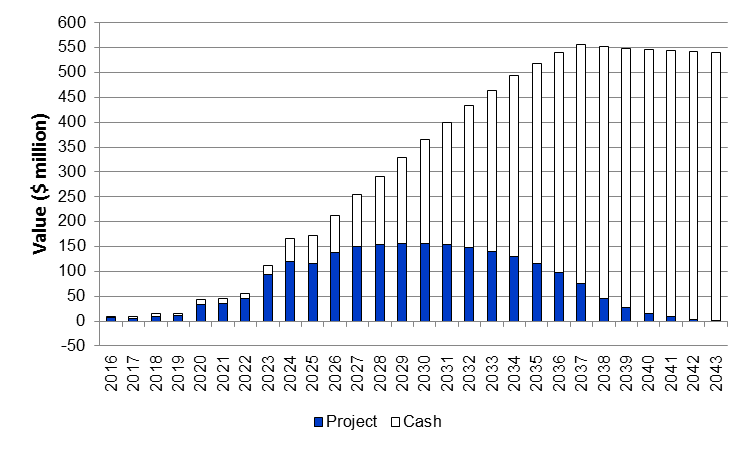

Figure. Deal limits for Biotech and Pharma

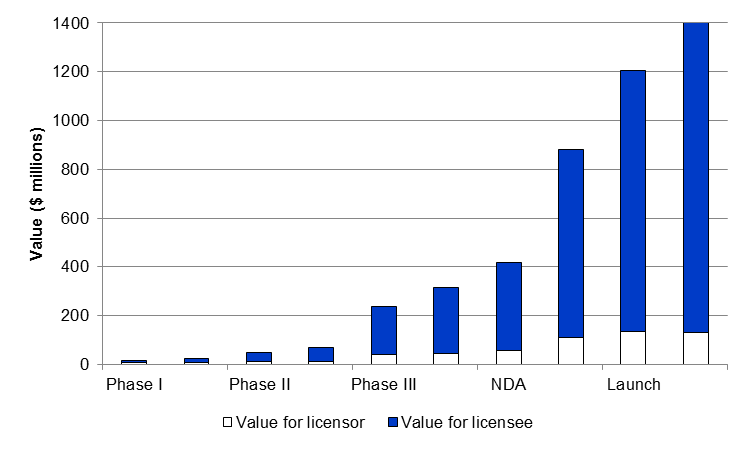

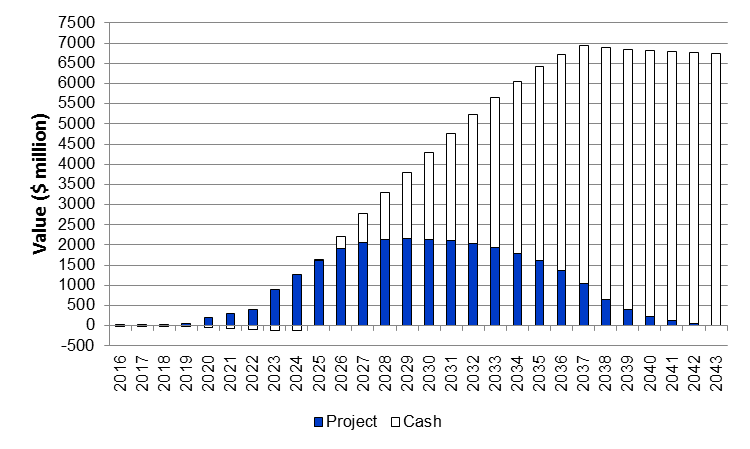

Figure. Value development for Biotech and Pharma

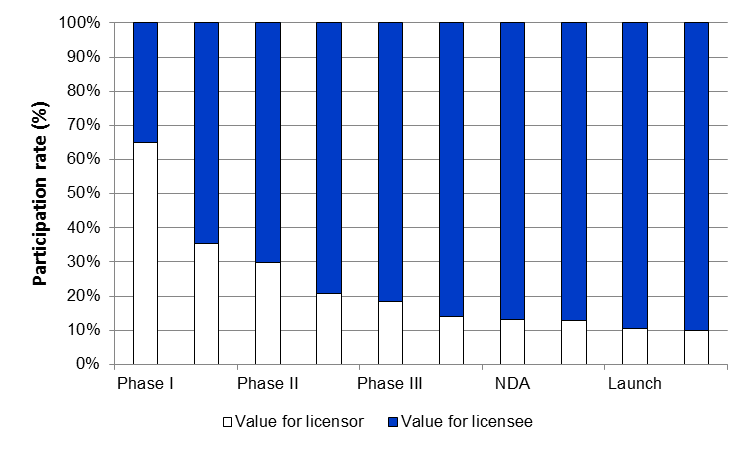

Figure. Ownership changes following milestone payments and capital contributions.